Mutal Funds are managed portfolios of different types that are created and maintained by Asset Management Companies (AMCs). There are 45 AMCs in India as of March 2024. Three of the largest AMCs in India as of March 2024 are SBI Mutual Fund, ICICI Prudential Mutual Fund and HDFC Mutual Fund. AMCs such as these raise funds from public and institutional investors to invest and manage various types of portfolios for them for a cost. AMCs issue units against an investment. Just as how stocks have prices, mutual funds’ prices are called Net Asset Values (NAVs). This is calculated as the total assets of a fund divided by total number of units.

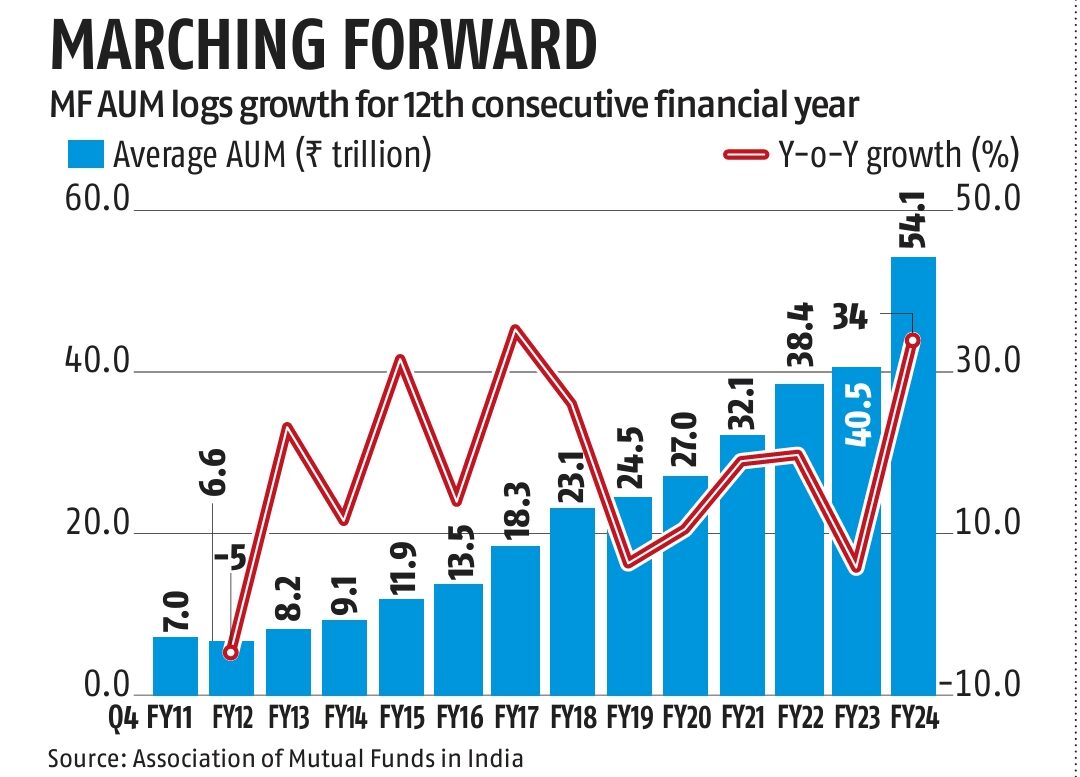

Traditionally, Indians prefer to invest in bank fixed deposits (FDs), gold and direct real estate. However, since 2010, the Indian financial markets are maturing rapidly with increased awareness and participation of the public.

Mutual Funds come in all shapes and sizes. Feel like infrastructure is the next big thing? You can leave the investment in a good portfolio of investment related stocks to the experts, the fund managers of an infrastructure sector mutual fund. Feel that the market is overvalued? You can easily invest in a basket of debt securities with relatively less volatility through debt mutual funds. You think that silver is going to bring on a great shine soon? Choose a silver commodity mutual fund. The possibilities of such managed portfolios are limited to one’s imagination!

Just as a meal is comprised of various items that come together to make it wholesome, it is essential to have a portfolio of 5-6 good mutual funds. But first let us dig right in and see what the main options on the extensive menu of mutual funds are.

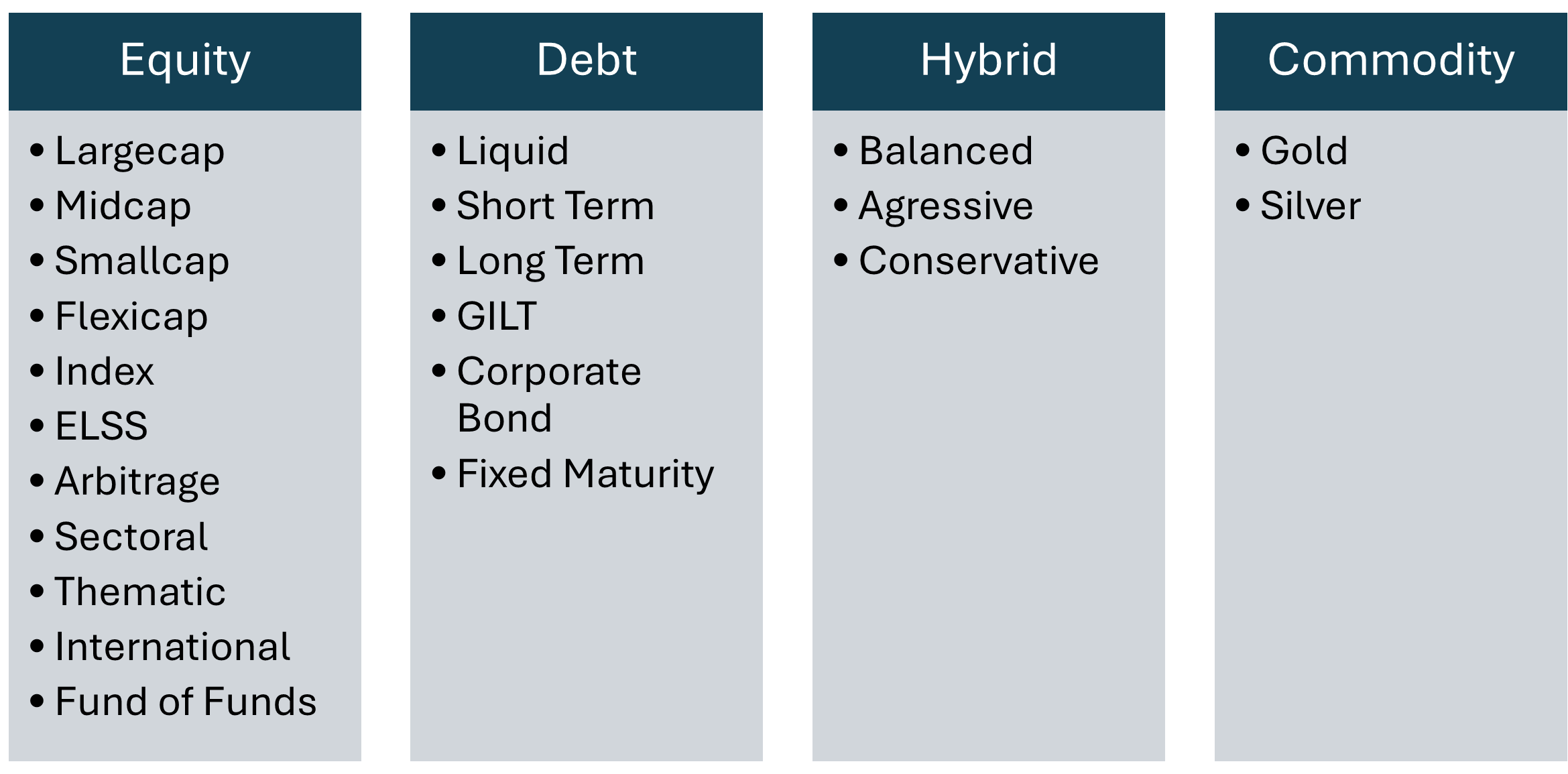

Equity Mutual Funds

These funds invest primarily into shares of listed companies of various sizes. They are further categorized depending on the investment mandate and specialisation. The most popular and relevant categories are as follows.

Largecap Funds invest at least 80% of their portfolios in the top 100 largest companies by market capitalization. Market capitalization (market cap) means the total outstanding number of shares multiplied by the per share price, which gives the total value of a company. These funds are more stable and enable defensive investing for goal-oriented investment approaches.

Midcap Funds invest at least 65% of their portfolios in 101st to 250th largest companies by market cap. The NAVs of these funds fluctuate more due to the smaller size and lesser liquidity of the shares of these companies. However, currently these funds offer the best compounded returns considering price fluctuations over a long term of 5-10 years.

Smallcap Funds invest at least 65% of their portfolios in stocks of the 251st onwards largest companies by market cap. These have offered similar returns to Midcap funds in the last decade but come with more volatility, which is fluctuations in price. These funds are relatively more sensitive to market cycles. If you consider the shorter term of the preceding 1-3 years, these funds have given the best returns.

Flexicap Funds are the flagship active equity funds. Managers of such funds are free to invest across market caps at their discretion but must invest at least 65% of the assets in equities. This is exactly what an Active strategy means. These funds outperform Largecap funds during bull markets. However, it is difficult to outperform the indices significantly, and the longer term returns from such funds are not too far from other equity funds such as Midcap funds.

Index Funds are passive funds as opposed to active funds. These track various indices such as NSE Nifty 50 or S&P BSE Sensex, by allocating capital in the same proportion as the main indices of the country. For investors who do not have the time or the inclination to build and manage portfolios, it is a wise strategy to simply keep investing a proportion of income in a single good index fund regularly on auto mode through SIPs. Index funds have a good history of representing the overall market returns and economic growth of a country with the least cost, since they are managed passively with lower number of changes in the portfolio (called churn). However, a fund with the lowest tracking error must be selected to get the best replication of index returns. Tracking error is the difference between a fund’s and index’s returns. This occurs to due to management procedures, trading and operational costs.

I love index funds because have the features of Largecap funds but at a much lower cost. There have been many periods when main indices in India have outperformed mid and small caps, which gives great optionality to such funds, depending on the status of the market cycle.

ELSS (Equity Linked Savings Scheme) Funds are a special category of equity mutual funds that carry taxation benefit. Investment in these funds for up to ₹1.5 lacs is reduced from taxable income under section 80C of the Income Tax Act. Thus, tax up to the net tax rate times this amount can be saved. These funds have a lock-in of 3 years post which capital gains are subject to tax rules applicable to long term capital gains tax from equity. ELSS funds are mandated to invest 80% of the assets in equity securities. These funds are a great way to save on taxes while earning the returns equivalent to those of large cap funds and a must for most portfolios.

Arbitrage Funds are unique in that they are less volatile but provide but lower returns equivalent to those of short-term debt funds. Thus, these funds are also categorized as hybrid funds. However, these funds are mandated to invest 65% of the assets in equites and hence I have categorized them as equity funds. These funds carry out arbitrage strategies to generate an annually compounded return of 5-7%, with added advantage of lower taxes. Arbitrage strategies involve taking advantage of price differentials of same or similar assets across different markets. For example, there could be temporary differences between cash market and derivates market. In most investment cases, debt funds and listed bonds may provide a more suitable return profile.

Sectoral Funds focus on specific sectors such as infrastructure, pharma and IT sector. These funds are mandated to invest at least 80% of assets in equities in the chosen sector. Sectors are cyclical and hence these funds tend to be highly cyclical as well. As such, it is difficult to predict which sector will outperform the market, so in ordinary circumstances, it is better to stick to a non-sectoral fund.

Thematic Funds invest in a particular theme across themes. For example, banking or logistics funds. These are similar sectoral funds in terms of mandate and features.

International Funds invest in capital markets abroad. However, given the long runway for growth in India, I believe these funds may not be attractive. Many experts say that these funds provide diversification, but global markets largely move in tandem. These funds may have an advantage in terms of currency appreciation against the rupee, but then again you would have to predict macroeconomic variables accurately, which is a big gamble.

Fund of Funds invest in units of other funds. Generally, these do not add much value since any type of portfolio can be built easily with all the available choices in the market.

There are a few other categories that I believe are not relevant, such as closed mutual funds and solution-oriented funds for savings that come with similar return profile of large cap funds, but with greater lock-in periods and lesser liquidity and flexibility. Equity mutual funds would generally form a core part of the mutual fund portfolio.

Debt Mutual Funds

Debt funds invest in corporate and government bonds and other debt securities of various tenures. They are categorized primarily according to the quality (ratings) and tenure of the debt securities held.

Liquid Funds invest in debt securities very short-term maturities that vary from overnight to 12 months. They may be further placed in sub-categories such as money market funds, etc. according to maturity period of the portfolio. Their returns vary between 5-7% pre-tax over a term of a year, but they can have some variance in a shorter period. If 0.5-1% returns are not consequential then sticking to shortest maturities is the way to go.

Short Term Debt Funds invest in debt securities maturing in 1-3 years and provide a return that is slightly more than Liquid Funds but are more sensitive to changes in interest rate by Reserve Bank of India (RBI).

Long Term Debt Funds invest in debt securities that have medium to long maturities of more than 3-7 years. These are most sensitive to interest rate changes as decided by RBI during its bi-monthly meetings. As interest rates rise, the prices of bonds and debt funds investing in them fall. As the interest rate cycle peeks and rates are cut, prices of bonds and debt funds rise, and these longer maturity funds give the best returns of around 10-13%. However, it is tough to predict exactly when the interest rate cycle peaks and troughs.

GILT Funds have the mandate to invest at least 80% of the portfolio assets in central and state government debt securities (G-Secs) such as bonds and treasury bills. These funds have lowest default risk since the securities are guaranteed by the government. Such securities have a ‘SOV’ rating, which stands for the word ‘sovereign’. Currently these funds have a similar return profile to medium term debt funds.

Corporate Bond Funds seek to gain from taking on credit risk with bonds issued by listed and unlisted companies. These companies can be from any sector, but the most common sectors are banking and power. If you are investing in such a fund, it is imperative to also take into account the average maturity of the fund and where we stand in the interest rate cycle. Pure Corporate Bond funds are to invest at least 80% of their assets in bonds rated AA or higher. However, there are sub-categories that allow for more relaxed requirements on the ratings and greater discretion by the fund managers. It is pertinent to note that the ratings of a security may not be aligned with the actual fundamental position of the company that is issuing the debt security. While ratings do provide good inputs, the key principle when analysing debt securities is Caveat Emptor, which means ‘buyer beware’.

Fixed Duration Funds invest and manage debt portfolios to maintain a constant duration. Duration measures a bond’s or fixed income portfolio’s price sensitivity to interest rate changes, and maybe measured in years which makes it a confusing concept. Duration is directly related to price. As the price of a bond goes up, the duration of the bond also goes up and vice versa. The idea behind these funds is to book the profits once the bond prices rise and reinvest the profits in securities with lower prices and lower. Generally, other debt funds are adequate to cover the need for fixed income allocation.

Debt funds are a great way for capital protection and help in managing temporary excess liquidity. They are a safe investment option for emergency funds, which makes them indispensable for any portfolio.

Hybrid Mutual Funds

Hybrid funds invest in both debt and equity securities in a pre-defined ratio according to their mandates.

Balanced Hybrid Funds invest 40% to 60% of assets in equity and debt instruments depending on market scenario. Thus, these funds give a lower but more stable return of 10-12% over a long-term horizon of five years plus.

Aggressive Hybrid Funds invest a larger portion of 65-80% of assets in equity shares and the balance 20-35% in debt securities. These funds give 13-15% compounded annual returns (CAGR) over 3-5 years, with a little more stability in returns.

Conservative Hybrid Funds on the other hand invest 65-80% of assets in debt instruments and the balance 20-35% of the assets in equity shares. Thus, these funds give a lower but more stable return of 8-10% CAGR over a long-term horizon of five years plus, which is similar to long term debt funds.

Hybrid funds can be a good approach for those who are unable to put in the time and effort to build a portfolio to extract excess returns from the markets. As one ages and has a need of lower volatility and better capital protection, such funds can be made a part of the investment portfolio.

Commodity Mutual Funds

These funds invest in Gold and Silver related instruments and serve as a proxy to investment in bullion. They are generally traded on the exchange just like a stock and their NAV changes constantly as trades take place during market hours. Such funds that are traded on exchanges just like stocks are called Exchange Traded Funds (ETFs).

In the case of Gold funds, the units derive value through holding of 99.5% purity physical gold or gold receipts. Similarly in case of Silver funds hold 99.9% purity silver bars or exchange traded silver derivates as underlying assets. These funds appoint custodians who are responsible for the safe keeping of assets.

The actual returns these ETFs might be lower than those given by gold or silver directly due to various costs associated with creating and manging the fund and underlying assets. In return, these funds give the convenience of investing in these hard assets just with a phonecall to the broker.

Bullion performs well when there is a perception of higher risk in the financial markets and when there is more fundamental demand. However, the relationship of interest rates in an economy and price of gold is not a clear one.

Common Features of Mutual Funds

Mutual funds cover mostly all asset types and we have covered the most important ones above. AMCs now offer enhanced flexibility in terms of the investment patters that allow for automation in the investment process.

Systematic Investment Plans (SIPs) are a way to average the cost of desired mutual fund portfolio. AMCs allow investors to invest a fixed or varying amount of money into a scheme over a fixed interval for a fixed period. This allows an investor to manage cash flows better. Depending on the position of market cycle, a lumpsum investment might be a better option. However, for those who cannot track the market daily, the SIP amounts can be varied according to market levels, since anyways the exact bottoms and peaks of markets cannot be predicted.

Systematic Transfer Plans (STPs) allow investors to switch funds from one scheme to another periodically. This gives the convenience of automatically transferring gains from an equity scheme to a more stable debt scheme, for example.

Systematic Withdrawal Plans (SWPs) are the opposite of SIPs. Say an investor wants periodic income post retirement. They can create a SWP to withdraw a fixed sum every month through a SWP.

To invest in mutual funds, an investor can invest either in the Direct plans, through the AMC of the fund or in Regular plans through an advisor that helps manage the investment. Regular plans carry distribution commissions as additional expenses and hence give lower returns than Direct plans. Wherever possible, it is better to invest in Direct plans.

The AMCs offer the option to either book profits in the form of Dividend option or to enable compounding of returns through the Growth option. Growth option is always the preferred option since it allows for compounding of investments over time.

Picking the Right Mutual Fund

Mutual funds allow creation of any kind of portfolio that is imaginable. Now that you understand the nature, categories and features of mutual funds, let us dive into the most important factors for selecting mutual funds according to your investment requirements and financial situation.