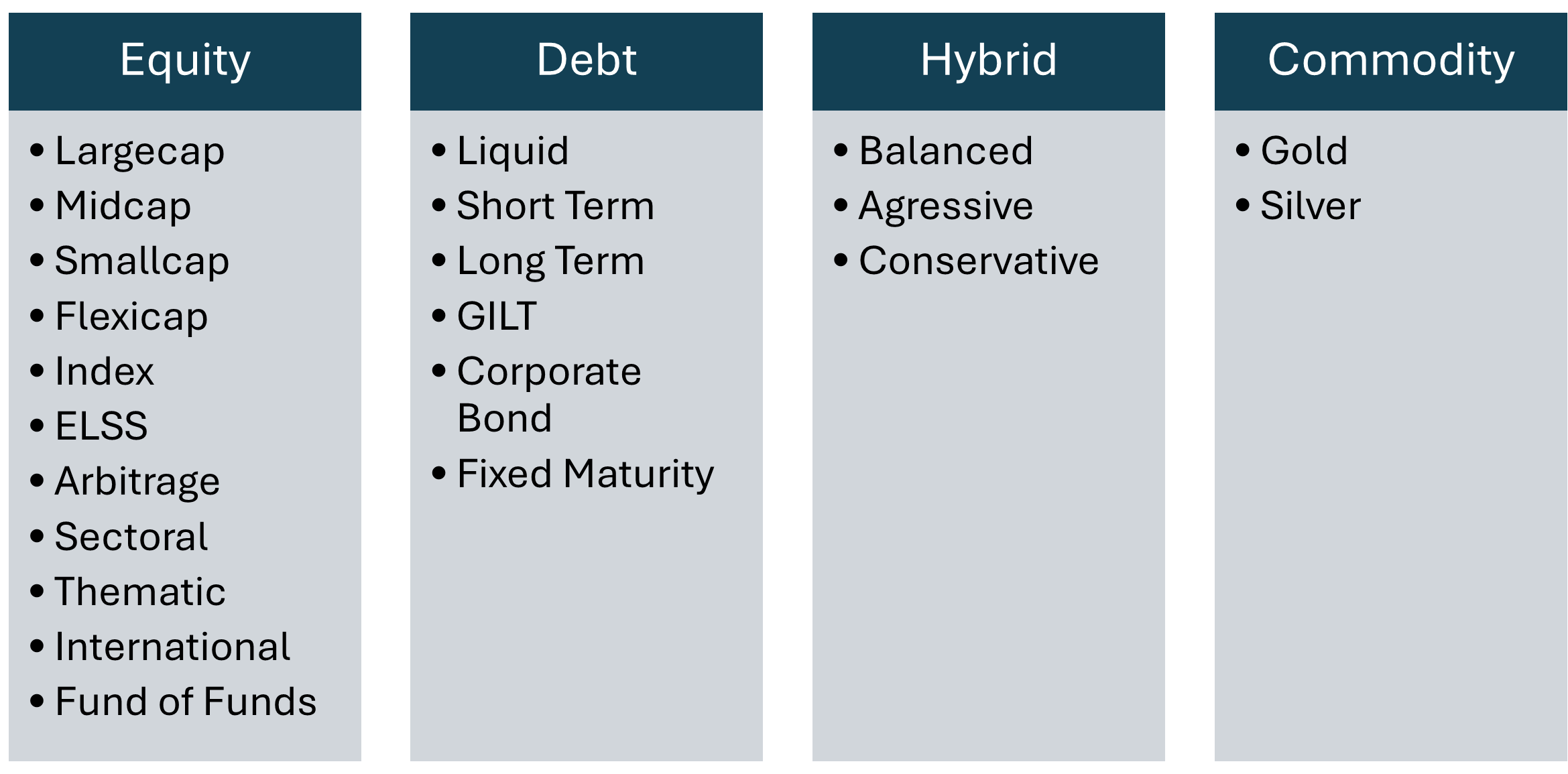

The number of types of mutual fund schemes is dizzying:

While it may be intimidating at first, after studying the various types of mutual funds available in India, you will come to realise that there are only a few categories that would be truly relevant to your investing goal. Once you have figured out the best fund category depending on your circumstances and criteria, it is important to analyse certain parameters of various funds within that category to pick the one that is best suited to your needs. The following are the main parameters that I check to home into the perfect fund for my portfolio.

Fund House (AMC)

It is preferrable to select an Asset Management Company (AMC) that is large in size and that has a long history in managing money. There are new AMCs that have come into the mutual fund space recently such as Quant, which has performed well and is a hit with new investors in the market. However, I prefer to select AMCs such as SBI Mutual Funds or HDFC Mutual Funds that have a tested institutional set-up and processes in place for things like developing new products, vendor management as a fund house, replacing fund managers, etc. Ideally, an AMC should have at least 10-15 years under its belt and experienced multiple market cycles.

When making investments, it is better to avoid fund houses that may not have good management practices in the recent past. Once the leadership of such a fund house changes, then it can be reviewed once again.

Fund Manager

It is worthwhile to study the background and evaluate the approach and investing style of the fund managers of the funds that are interesting to your situation. Their performance in managing other funds can also be checked. It is important to note that the role of the fund manager is more important when selecting active funds as opposed to passive funds that just hold the same stocks in same proportion as an index. Ideally, a fund manager should not have more than 3 mutual funds to manage.

Portfolio Constituents

A fund that stands out in returns as compared to peers would have a different allocation to various stocks. The stocks held by the fund manager can help in deciding if the fund would be diversifying your portfolio or if there would be overlap. If you are already holding many of the stocks that are in the portfolio of the fund in consideration, then adding the fund would not help in reducing risk or giving a different exposure. It is desirable to add mutual funds that complement your direct stock holding, not overlap it. Understanding the sector and stock specific allocation is important to know the real risk that a fund bears. This is especially true for debt funds. Many debt securities maybe rated the highest – AAA. Yet there have been cases in the past when AAA rated companies have defaulted, for example take the case of DHFL Ltd., a prominent housing finance company.

Expense Ratio

Expense ratio represents the cost charged by the AMC to you, as an investor in the fund. The lower this is, the better. For passive oriented funds such as index funds and short-term debt funds, the expense ratio tends to be low as compared to active funds. The expense ratio is expected to be similar across similar peer funds. The idea is to look for a fund that has a lower expense ratio and is outperforming most of the peers.

Sharpe Ratio and Beta

Sharpe Ratio is the returns of the fund adjusted for the price fluctuation (standard deviation) in its performance. When investing in mutual funds, it is better to hold a fund that can provide steady returns rather than a fund that performs well but fluctuates a lot historically. This number is generally greater than 1 and less than 2. The higher it is, the better.

One of the key reasons to hold mutual funds is that they provide diversification. Beta is a measure of the correlation of the price movement of a fund with the movement of the market index. Practically, it is observed that this number can vary between 0.5 and 1.3. The lower the number the lesser the correlation with market movements, and the higher the Sharpe Ratio. Higher Beta implies higher fluctuation compared to market movements.

Therefore, keeping other factors constant, we look for funds with higher Sharpe Ratio and lower Beta.

Age of the Fund (Vintage)

In a bull run everything goes up and looks great. But it is crucial to see the fund performance over multiple market cycles to get an idea of the expected returns from a fund and compare it to peers. A fund should be at least 10 years old ideally.

Average P/E (Price to Earnings Ratio)

While historical P/E is not a great predictor of future performance, it does give an idea of where we stand in a market cycle. Historical P/Es compared to themselves do give a range. This means that markets generally trade in a certain range of aggregate P/E multiples. In the context of mutual funds, a fund’s constituents’ average P/E ratio can give an idea about the investment approach and the orientation of a fund in terms of growth or value investing. The lower the P/E, the higher the chances of better future returns.

Assets Under Management (AUM)

Assets Under Management for a given mutual fund is the total amount that a fund house has collected for that mutual fund scheme. Higher the AUM, the more stable a fund will be. It will also imply a better liquidity for the fund. This means that it will be easier to redeem the funds once a goal has been reached. Outperforming funds that have smaller AUMs may not perform as well in the future. This is because once the funds get additional capital, they are not able to deploy it tactically due to higher costs associated with acquiring huge quantities of shares, as the prices of the shares to be acquired starts moving up with large buy orders. This is called Impact Cost.

Exit Loads

Funds may charge an exit load of 1-2% of the current value invested when a fund is redeemed between 1 to 3 years after purchase. This means that if you want to switch over to another fund in the short run due to some reason, your transaction costs will increase. The lower the Exit Load, the more flexibility in investment choices.

—

The data for each of these factors for all funds can be obtained from scheme documents from AMCs and various aggregator websites easily. I prefer the Value Research platform, which has great coverage on mutual funds, and offers a free and excellent portfolio management and tracker tool.

Apart from the above factors for individual funds, it is essential to keep the big picture in mind when selecting mutual funds.

A good portfolio should not have more than 5-6 mutual funds across various categories. Anything beyond this leads to portfolio overlap and simply increases the costs and complexity of the portfolio, without adding much value. For instance, one can choose either to hold an index fund or a large cap fund. Since the index has a great selection of large cap stocks, the difference in the performance of the two will be minimal.

Since mutual funds are just baskets of a bunch of stocks, the expected return for a mutual fund will be similar to that of the stocks with highest weightage in the fund.

As of March 2024, as per data from SEBI, there are 45 AMCs offering 1541 schemes that can cover virtually any investment idea or approach imaginable.

New Fund Offers (NFOs) are generally hyped up and pushed onto gullible investors by distributors. As mentioned above, having a vintage for fund is important for performance and operational reasons.

An allocation to a basket of mutual fund requires a long-term horizon of at least 5 years to judge whether it is effective or not. In the unlikely event that after 5 years, the mutual fund portfolio returns are much lesser than market returns, you need to look at the above factors again and change the portfolio mix. Another factor is age. As you grow older, you generally want more stability rather than high returns. This implies a gradual shift from pure equity to balanced, hybrid and debt funds.

The world of mutual funds is interesting with lots to explore. Just as with anything in life, it requires effort, time and patience.